AMD CEO forecasts a decade-long AI boom. Explore its impact on chips, investments, and the future of AI infrastructure in 2025.

Introduction: A Decade That Will Redefine AI

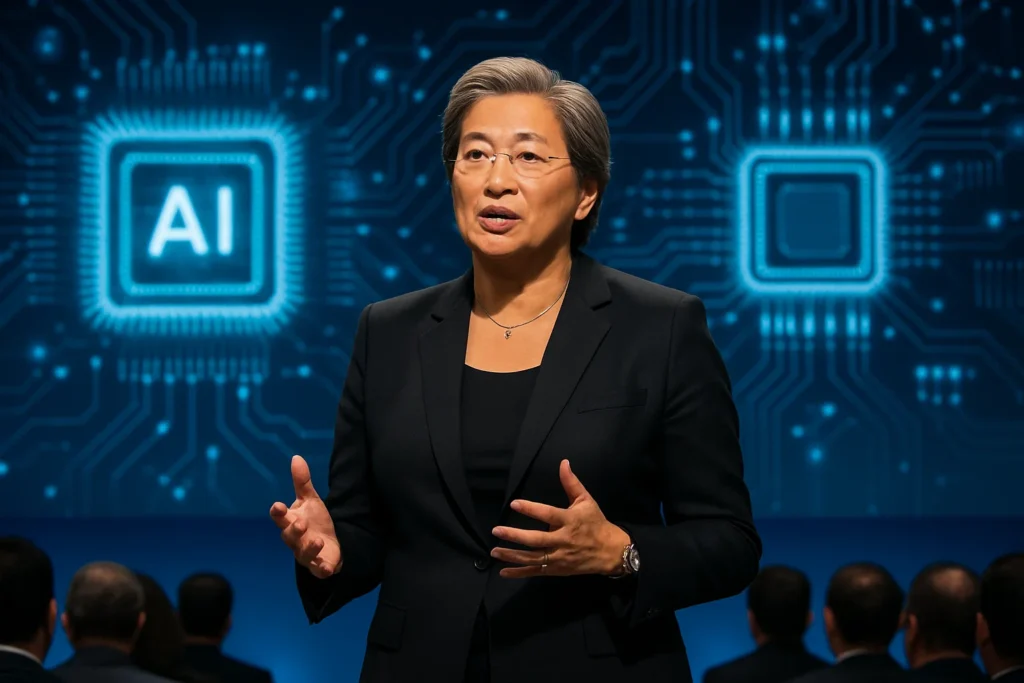

In 2025, the global technology landscape is being rewritten by artificial intelligence (AI). At the center of this transformation, AMD CEO Dr. Lisa Su has made a bold prediction: a “massive ten-year AI boom” that will reshape not only chipmaking but also investment strategies across industries.

For U.S. investors, chipmakers, policymakers, and enterprises, this prediction is more than a headline—it’s a roadmap to the future of AI economics. As competition intensifies between AMD, NVIDIA, Intel, and custom AI accelerators, the stakes have never been higher.

In this article, we’ll break down:

- Why AMD is betting on a decade-long AI explosion.

- The implications for chip innovation and semiconductor supply chains.

- The investment opportunities and risks for U.S. markets.

- How policymakers and enterprises should prepare for the coming wave.

AMD’s Big Bet on AI: Why This Boom Matters

Dr. Lisa Su’s forecast isn’t just optimism—it’s rooted in hard market realities. AI workloads are exploding, from generative AI models like ChatGPT to enterprise deployments in healthcare, finance, defense, and logistics.

Market Signals

- AI Spending: IDC projects global AI spending to surpass $500B annually by 2030.

- Chips as the Backbone: Semiconductors are the “picks and shovels” of this boom, fueling both training and inference of large models.

- Enterprise Adoption: McKinsey reports that 65% of enterprises in the U.S. will integrate AI into core business functions by 2027.

AMD sees this as a multi-layered decade-long opportunity: not just for chips, but for platforms, software optimization, and custom AI partnerships.

Chips: The New Oil of the AI Economy

The AI boom positions chips as the most valuable commodity of the digital age. AMD, NVIDIA, and Intel are racing to dominate a market where every model requires immense compute power.

Training vs. Inference

- Training Chips: GPUs and accelerators capable of processing trillions of parameters.

- Inference Chips: Power-efficient processors for deployment in data centers, edge devices, and consumer products.

AMD’s MI300X GPU series is already making waves, competing with NVIDIA’s H100 in enterprise AI workloads. Su’s prediction implies sustained demand across both training and inference chips for the next decade.

The AI Infrastructure Boom

A massive AI boom is not just about chips—it requires entire infrastructures.

Data Centers: The New Factories

- Hyperscalers (Amazon, Microsoft, Google) are investing billions into AI superclusters.

- AMD is positioning itself as a supplier of choice for these hyperscale data centers, focusing on energy efficiency and cost-per-performance ratios.

Energy and Cooling Challenges

The U.S. power grid and data center operators face mounting concerns:

- AI training already consumes more energy per week than some mid-sized countries.

- Cooling solutions, including liquid cooling and immersion, are now critical in data center design.

Investment Outlook: Where the Money Will Flow

Lisa Su’s prediction is not just about technology—it’s a direct signal to investors.

Key Investment Areas (2025–2035)

- Semiconductor Stocks – AMD, NVIDIA, Intel, Broadcom, and Taiwan Semiconductor Manufacturing Co. (TSMC).

- AI Infrastructure ETFs – Funds focusing on data centers, cloud providers, and chipmakers.

- AI-Driven Startups – Healthcare AI, robotics, autonomous driving, and fintech.

- Green Energy & Cooling – Renewable energy providers catering to power-hungry AI infrastructure.

Risks Investors Should Watch

- Supply Chain Disruptions: Geopolitical tensions around Taiwan (TSMC’s dominance).

- Overvaluation: AI hype cycles can inflate market caps beyond fundamentals.

- Regulatory Pressure: The U.S. and EU are pushing for AI safety frameworks, which could slow down adoption.

U.S. Policy and National Security Dimensions

AI’s rise is not just economic—it’s geopolitical.

- National Security: Advanced chips are central to defense and intelligence applications.

- Export Controls: The U.S. has already restricted high-performance AI chips to China, reshaping global supply chains.

- R&D Incentives: Initiatives like the CHIPS and Science Act aim to reshore semiconductor production and keep America competitive.

For policymakers, Lisa Su’s decade-long boom forecast underscores the urgency to balance innovation with regulation.

What This Means for Enterprises in the U.S.

For U.S. businesses, the AI boom represents a once-in-a-generation productivity leap.

- Healthcare: AI-assisted drug discovery and diagnostics.

- Finance: Algorithmic trading, fraud detection, and risk management.

- Manufacturing: Predictive maintenance and robotics.

- Retail & Consumer: Personalized recommendations and supply chain optimization.

The companies that integrate AI responsibly and efficiently will see outsized returns over the next decade.

AMD vs. NVIDIA: The Decade-Long Rivalry

NVIDIA may dominate AI chips today, but AMD is closing the gap fast.

- NVIDIA’s Lead: CUDA software ecosystem and H100 dominance.

- AMD’s Strength: Cost efficiency, open software frameworks, and partnerships with hyperscalers like Microsoft Azure.

- Long-Term View: A ten-year AI boom provides enough runway for AMD to chip away at NVIDIA’s market share, especially in inference workloads.

Looking Ahead: The Next Ten Years of AI Chips

By 2035, the AI chip market could look radically different:

- Custom Silicon Proliferation: Enterprises like Google (TPUs) and Amazon (Trainium) building in-house AI chips.

- Quantum + AI Hybrids: Early experiments in quantum computing integration.

- Edge AI Explosion: Billions of consumer devices embedded with inference chips.

AMD’s bet is that diversification + partnerships + efficiency will allow it to thrive in this decade-long boom.

Conclusion: A Decade of Transformation

Dr. Lisa Su’s forecast of a “massive ten-year AI boom” is more than just a CEO soundbite—it’s a reality investors, enterprises, and policymakers must prepare for.

Chips are becoming the new economic foundation, driving breakthroughs in every sector from medicine to defense. For AMD, this is a rare moment to challenge NVIDIA’s dominance and secure its place in the AI-driven economy.

For investors, the message is clear: semiconductors and AI infrastructure will define the next decade of returns. For policymakers, the focus must be on supply chain resilience, energy sustainability, and regulatory balance.

The AI boom is here. The only question is: who will lead it, and who will be left behind?

FAQs

1. Why does AMD predict a ten-year AI boom?

Because AI adoption is accelerating across industries, requiring sustained demand for chips, infrastructure, and enterprise solutions.

2. How will this AI boom impact chipmakers like AMD and NVIDIA?

It ensures long-term growth opportunities, though competition and innovation will intensify.

3. What investment opportunities does this create?

Semiconductors, AI ETFs, renewable energy for data centers, and AI-focused startups.

4. Are there risks in investing in AI now?

Yes—overvaluation, supply chain risks, and regulatory uncertainty.

5. What role will U.S. policy play in this boom?

It will be crucial in funding R&D, securing supply chains, and setting ethical AI standards.