Cnergyico will import 1 million barrels of U.S. crude oil from Vitol in October 2025—Pakistan’s first-ever American oil deal. Learn how this strategic shift could reshape the country’s energy sector and trade dynamics.

🇵🇰 Pakistan to Import First U.S. Crude Oil: Cnergyico-Vitol Deal Marks Historic Trade Shift

📌 Introduction

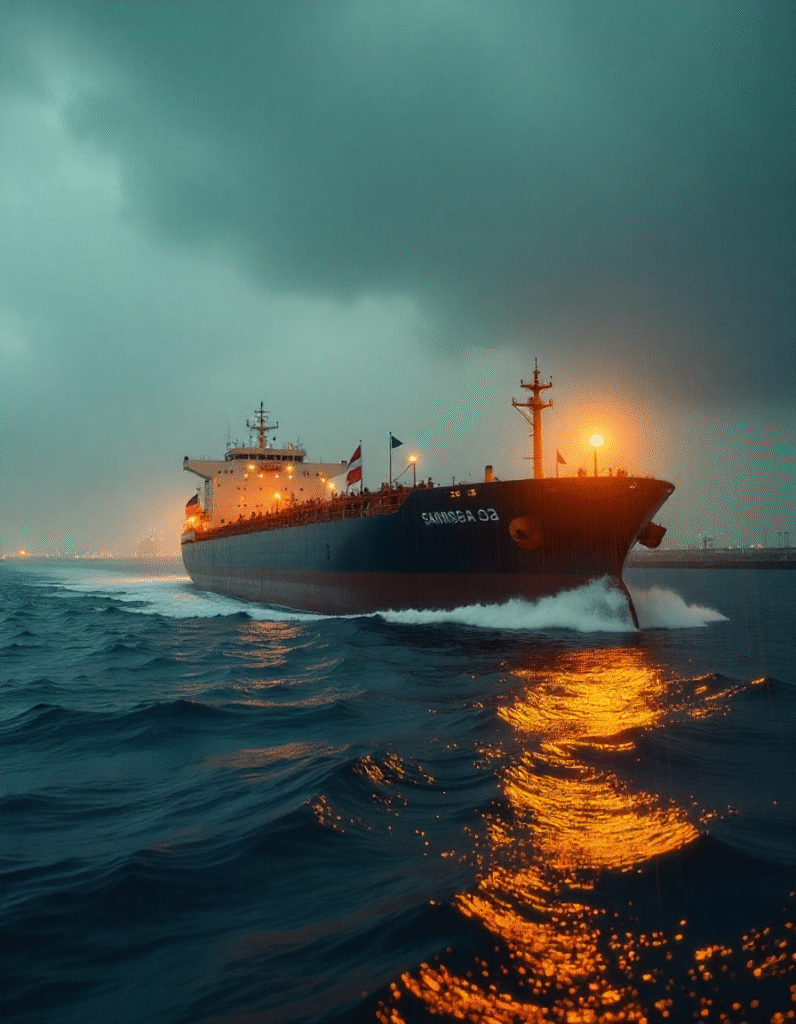

In a major shift in its energy strategy, Pakistan has finalized its first-ever crude oil import from the United States. The deal involves 1 million barrels of West Texas Intermediate (WTI) light crude to be shipped by Vitol, one of the world’s top oil traders, to Cnergyico, Pakistan’s largest private refiner.

This cargo, set to arrive in Karachi in October 2025, marks a significant milestone for Pakistan’s energy diversification and international trade relations, particularly with the United States.

🛢 Why This U.S. Crude Import Matters for Pakistan

1. Breaking Dependency on Gulf Oil

Historically, Pakistan has relied almost entirely on Middle Eastern oil, especially from Saudi Arabia, UAE, and Kuwait. According to fiscal year 2024–2025 data, Pakistan spent over $11.3 billion on crude imports, accounting for nearly 20% of its total import bill.

This U.S. crude import allows Pakistan to:

- Diversify supply sources

- Reduce geopolitical dependence on the Gulf

- Secure favorable pricing opportunities in the global oil market

2. Bilateral Trade: From Tariff Threats to Energy Cooperation

The deal followed months of negotiations that started in April 2025, after former U.S. President Donald Trump threatened to impose 29% tariffs on Pakistani imports. The final agreement settled at 19%, coupled with increased U.S.–Pakistan energy cooperation.

Pakistan responded to the tariff pressure by offering to import American energy products, thereby reducing its trade surplus with the U.S. and gaining diplomatic ground.

⚙ Cnergyico’s Role in the Import Deal

About Cnergyico

- Largest private oil refiner in Pakistan

- Operates a 156,000 barrels-per-day facility

- Runs the country’s only Single Point Mooring (SPM) terminal for offshore oil handling

According to Usama Qureshi, Cnergyico’s Vice Chairman:

“This is a test spot cargo under our umbrella term agreement with Vitol. If it is commercially viable and available, we could import at least one cargo per month.”

This shipment is not for resale; it will be refined and consumed domestically.

Future Expansion Plans

Cnergyico aims to:

- Build a second offshore terminal

- Upgrade refining technology

- Increase its run rate from the current 30–35% utilization as domestic demand improves

These upgrades will prepare the company for more complex, larger-volume imports in the future.

⚖ WTI Crude vs Gulf Grades: What Makes It Viable?

1. Technical Compatibility

Cnergyico confirmed that no refinery modifications are required to process WTI light crude.

- Gross Refining Margin (GRM) is on par with Gulf grades

- No blending or chemical adjustments needed

This makes U.S. crude a ready-to-use alternative, offering operational flexibility to the refinery.

2. Cost & Commercial Feasibility

While WTI is often cheaper than Gulf crude, shipping costs from Houston to Karachi are high. This test shipment will evaluate:

- End-to-end logistics cost

- Refining margins

- Market viability for consistent monthly imports

If positive, Cnergyico plans regular U.S. crude imports, reshaping Pakistan’s energy map.

🧾 Trade Deal Context: Pakistan-U.S. Energy Partnership

April 2025: Tariff Shock Sparks Oil Negotiations

The U.S. originally announced a 29% tariff on Pakistani imports. To balance trade, Pakistan proposed to:

- Import at least $1 billion worth of U.S. energy (crude oil and LNG)

- Allow U.S. companies to explore domestic oil reserves in Pakistan

- Strengthen bilateral ties through energy diplomacy

October 2025: Deal Finalized, Oil on the Way

Pakistan’s finance and petroleum ministries encouraged local refiners to explore crude import options from the U.S. The successful agreement signals:

- Improved relations with Washington

- Diversification from Gulf influence

- Potential economic benefit if tariffs are offset through trade balance

📉 Challenges & Risks Ahead

1. Shipping & Insurance Costs

U.S. to Pakistan shipping costs are significantly higher than Gulf routes. For regular imports to make sense:

- WTI must consistently stay cheaper

- Shipping efficiencies must improve

- Insurance costs must remain low

2. Political Uncertainty

If the U.S. changes its tariff policy or revokes trade preferences under future administrations, Pakistan may be left with a less cost-effective arrangement.

3. Internal Refining Constraints

Cnergyico and other refineries must operate at higher run rates to take full advantage of crude imports. Local demand and power sector fuel usage will play a critical role.

📈 Economic & Strategic Benefits for Pakistan

1. Enhanced Energy Security

Pakistan gains:

- Strategic control over multiple crude sources

- Flexibility in procurement

- Insurance against Gulf supply disruptions

2. Investment in Infrastructure

With a second offshore terminal on the roadmap and plans to modernize refining, Pakistan may attract:

- Foreign investment

- New international suppliers

- Better energy trading terms

3. Diplomatic Wins

Nomination of Trump for the Nobel Peace Prize by Pakistan, and increased U.S. engagement, have brought both countries closer. The oil import deal further cements diplomatic ties.

🌍 Regional Comparison: Other Asian Countries Doing the Same

Pakistan is following the path of nations like:

- India – large-scale U.S. LNG and crude imports

- Japan & South Korea – diversifying away from Middle East

- Thailand & Indonesia – building long-term partnerships with U.S. energy firms

All these countries aim to:

- Offset trade surpluses with the U.S.

- Lower energy risks

- Secure long-term supply contracts

📌 Conclusion

The import of U.S. crude oil by Cnergyico in October 2025 marks a historic turning point for Pakistan’s energy, trade, and diplomatic policies. It’s not just a single shipment—it’s a strategic signal:

- Pakistan is ready to diversify energy sources

- Build new trade relations

- And move toward refinery modernization

If this test cargo proves successful, monthly imports from the U.S. may soon become a reality—reducing dependency on Gulf oil, enhancing refining efficiency, and rebalancing Pakistan’s trade equation with its largest export partner.